Breaking News

Refinance Rumah Bank Rakyat Pinjaman

среда 06 февраля admin 63

Bank Islam offers a range of financing schemes to help individuals finance the purchase of their house or help them refinance their home loans.

Is a Bank Rakyat Home Loan Right for Me? Bank Rakyat Home Loan has a 5-year lock in period along with a penalty fee of up to 5% on your outstanding loan amount in case you plan to make an early settlement and repay your loan in full within this period. Compared with other loan products from other bank, Bank Rakyat housing loans has the highest lock in periods and penalty fees in the market. There are 2 main Bank Rakyat housing loan products. One of the outstanding product is Bank Rakyat Home Financing-i Manzili Selesa.

Ultimate drive increaser free download - Car Racing - Ultimate Drive for Windows 10, MotoBike Racing Ultimate Drive, Ultimate Drive, and many more programs. Security Software Home Software. Download ultimate drive increaser soft…. Ultimate drive increaser free download - Car Racing - Ultimate Drive for Windows 10, Primo Ramdisk Ultimate Edition, BounceBack Ultimate, and many more programs Navigation open search. Ultimate Drive Increaser, This Software Is Increaser. Ultimate Drive Increaser Free Download. Multimedia Office and News PC Games Photos. Download ultimate drive increaser pc software free shared files from DownloadJoy and other world's most popular shared hosts. Our filtering technology ensures that only latest ultimate drive increaser pc software files are listed.

This Bank Rakyat housing loan is a Sharia compliant home financing whose main attraction point is the convenient repayment method. For instance, you can make payments via Biro Perkhidmatan Angkasa if you are a government employee. Another alternative of repayment method is directly from your savings or current accounts. Besides the variety repayment alternatives, via this Bank Rakyat housing loan, you are protected against a hike in rates as it is based on a capped floating profit rate of 10.6%.

You can always pay in excess of your fixed monthly repayments but it will only count as an advanced payment since this Bank Rakyat housing loan is not a flexi-loan. On the other hand, the other Bank Rakyat housing loan namely Manzili Home-I Financing is very similar to its counterpart, Manzili Selesa. The exclusive feature of this Bank Rakyat housing loan is that you can make your loan repayments automatically through the deduction of salary through Biro Perkidmatan Angkasa (which appeals to government employees), employer payroll deduction and savings account deduction. Since this Bank Rakyat housing loan is not a flexi-loan, the excess payment that you have made will only reduce your principal amount instead of interest charges. The margin of financing offered can be up to 90% plus an extra 5% for MRTT and/or financed entry cost. Loan tenure can reach up to 35 years (in accordance to the latest ruling by Bank Negara Malaysia) or age 65 whichever is earlier.

When you are signing up for any Bank Rakyat housing loan products, it is highly recommended that you take on MRTT (which will protect you from any unforeseen scenarios. The requirement to apply for both Bank Rakyat housing loans is you do not have a bad track record with any financial institutions. Bank Rakyat Home Loan Packages The Sharia compliant home financing and package Home Financing-i Manzili Selesa offered by Bank Rakyat is designed to cater to the needs of Islamic banking costumers.

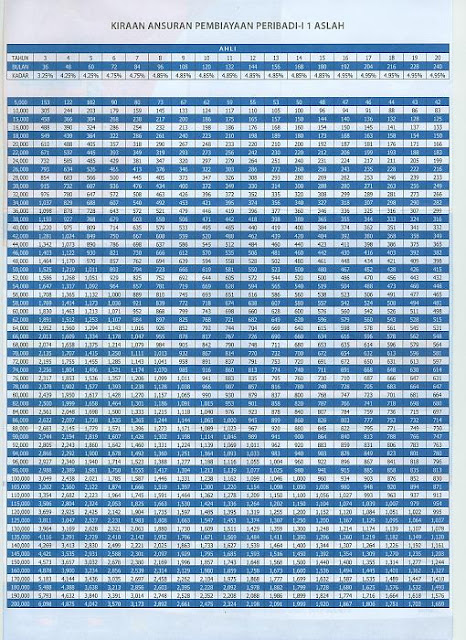

The main features of this package are highlighted in the table for you. Product Key Features Is this a flexi package? Home Financing-i Manzili Selesa • Profit rate from as low as - 2.4% • Margin of financing up to 95% (including MRTA) • Loan period up to 35 years No What Documents Will I Need to Prepare?

Pornhub is the most complete and revolutionary porn tube site. Video konkurs nudistok.